QPay offers a flexible payment option to benefit both the merchant and the consumer. Under this flexible payment option plan, consumers can choose to pay the total cost of the purchase in easy Equated Monthly Installments (EMI).

This option provides the merchant with more conversion and also helps the consumer to make the purchase and pay according to his cash flow. For more details on EMI Payment options, please contact support@QPayindia.com

Prevention is always better than damages / losses!

Online fraud and the subsequent damages to merchants / customers are really a matter of concern for QPay. In order to prevent fraud and have a clean / safe transaction process, QPay's risk experts have created an in-built and powerful fraud management system.

The system will analyze and verify each transaction data against various parameters to make sure the transaction is genuine. This improves the transaction success rate and reduces potential chargeback losses.

The QPay Mobile Checkout page feature is available by default in our API and can be used by merchants for their mobile apps / mobile site. In order to cover most of the mobile users, the QPay Mobile Checkout page has been designed to be compatible with iOS, Android, Windows Phone and BlackBerry.

We provide you with real-time statistical reports, thus enabling you to maximize your business potential with better decisions. Leverage on our reports for understanding your customer & boost your business!

We deploy a robust, seamless, fast integration procedure which ensures a secure online cardholder payment to the Merchant. QPay can be easily integrated with your site with minimal cost and effort. Our integration APIs, detailed integration kit and our well defined internal processes enables you to get started in a jiffy.

Our dedicated teams of experts are available 24x7x365 to solve your queries via email, chat and telephone - whenever you need it. We have customised solutions for each customer.

Integration with QPay India’s payment solutions is as easy as it gets! Our payment solutions can be integrated to any major website or platform. We will provide you with API’s that come along with detailed yet easy to understand activation kits and SDK’s to suit any platform.

There are occasions when a transaction fails to conclude for reasons due to wrong entry of card details, payment option etc, as a result the customer has to repeat the entire process again. This can be off putting and even results in the customer aborting the transaction and no sale made.

QPay gives customers a choice to use retry option which facilitates just entering the details in the payment page without going through the entire shopping process again. Merchants will benefit from this option because the customer has less chance of not completing the sale!

QPay offers merchants the choice of multi currency payment acceptance. This feature will enable the merchant to conclude the transaction in the currency of the customer’s choice. To enable this feature, Merchants need to inform QPay of the currency they would like to offer and QPay team will handle the rest.

QPay also supports acceptance of International cards for goods/services thus allowing the merchant to accept cards without segregation.

QPay gives the convenience of multi-lingual checkout to its merchants. In addition to English, QPay currently supports checkout in Hindi, Tamil and Gujarati for those customers who may prefer a local language content during payments and enhance their shopping experience.

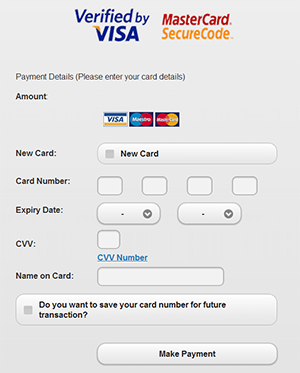

QPay Checkout provides the customers with an option to store their card details in a secured PCI environment with the flexibility to retrieve and use the same without entering the details again. During the next transaction, all they have to enter is only the CVV and 3D secure password to complete the transaction.

The card details are encrypted and stored allowing repeat customers to have a smooth and easy payment experience. This also facilitates customers to do transactions faster and encourages repeat purchases.

This feature allows the customers to have a seamless experience by facilitating the collection of card details in the merchant checkout page. The customer has a uniform experience of being in the merchant page while making a secure payment.

QPay offers its merchants the option of generating and sending the invoices at a time of their convenience to its customers with an online payment option. Merchants can create itemized invoices with their logo, look and feel, together with GST and have an online payment option to allow for easy payment of invoices by their customers.

QPay provides its merchants an option to sell and collect payments using the Social Media. Merchants can reach out to their customers in Social media and use QPay payment link to collect payments. Merchants can also generate QR code, display it in Store or publish in print media and collect payments instantly.

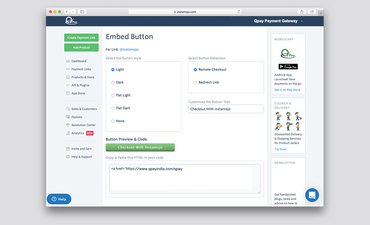

This is a simple and easy way for merchants to collect payments on their static website or blog. The merchants can create a payment facility as an embed button and paste in their site or blog to collect payments easily. No need for payment gateway integration as the embed button provides the facility for online payment collection. Merchants can setup payment buttons easily and start accepting online payments immediately.

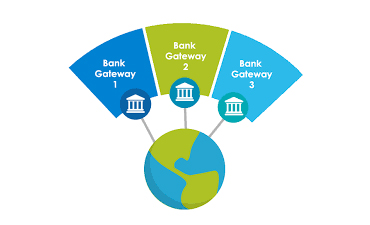

Switch transaction dynamically depending on banks performance to ensure consistently high transaction success rates.

One of the key fundamental factors for the success of online shopping is the seamless journey a customer takes to make an online payment. An uninformed failure in the payment process can majorly inhibit the customer’s re-use of the payment gateway.

For this reason, QPay India’s smart multi routing system selects the best performing bank gateway in the case when there might be inherent fluctuations in the system. This innovative feature majorly improves transaction success rates and makes the customer journey a lot more pleasant.

At QPay India, our approach towards problem solving is by providing customized solutions as per the case study. We work with merchants as a technology solution provider and not just as a payment service provider. We have a wealth of experience helping businesses like yours move into e-commerce. We can provide everything you need to start accepting payments online. Whether you're accepting one-off payments by credit and debit card or setting up regular payments, we have the solution to match your needs.

We have a dedicated team of tech professionals with a keen eye for automation and innovation that in turn helps us serve you better.

Recurring payment collection is the centre stone of tech focus for us here at QPay India. Across our digital solutions, we work vigorously to automate the process of recurring payments as it is hassle free for both the customer as well as the merchant. The solution that helps us provide automated collections to merchants are NACH and eNACH services.

NACH (National Automated Clearing House) mandate is a standing instruction (signed form) you provide to your bank or other institutions to automatically debit the instructed amount on a repeated basis from your nominated bank account. However, this process takes around 7 – 14 days to get processed and is also prone to human errors.

In order to solve these problems, electronic NACH forms have been introduced by the NPCI where the need to fill up a physical form is no longer necessary. The e-form can be authenticated via your Net Banking or Debit Card credentials, minimizing human interaction and time taken.

QPay India makes it possible for any merchant to collect repeated automated payments with the advent of eNACH services.

With the explosion of e-commerce, online marketplaces have made it possible for several merchants to serve a variety of customers. Hence, settlement and management of sale proceeds is a common concern for the marketplace as well as third party merchants. The % of commission to be paid and time taken to settle in the case of multiple merchants are key issues in fund management.

The solution that we offer is called Split Settlements that enables the transaction split to be received by all the participants in their bank account. You can either fix a certain value or % split for future transactions. This helps marketplaces automatically split payments, settle funds and deduct their commissions. Settlement will take place in T + 2 working days.

In certain online shopping cases, the customer finds it easier to pay the total amount in parts as opposed to paying upfront. Such situations arise when the purchase amount is significantly large or there is need for the merchant to collect a booking/ advance fee. Such unique requirements have made us work around the system to give customers and merchants convenience through the online shopping journey.

We make it possible for customers to split their purchases partially and can transact using our wide array of digital solutions. From our payment gateway to payment links, merchants can enable customers to make such diverse transactions as per their need. Last mile collections are also possible via our handy mPOS terminals!

Want to start selling your merchandise online now? Are you on the lookout for a viable digital platform for e-commerce? We’ve got your back! Leverage on our expertise and let us create a digital store for you to be able to showcase your merchandise. With your own domain and an integrated shopping cart, your customers will be able to shop your products and pay for them online through QPay India’s payment gateway. Your digital footprint needs to be out there!