Features

Payment Options

QPay India supports both Domestic & International Credit Cards and Debit Cards.

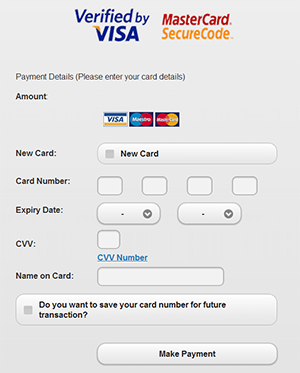

Credit Card & Debit Card

- Credit Cards (Master & visa)

- Debit Cards (Master, Visa, Maestro & Rupay)

Net banking

- 35+ Banks

UPI

- 30+ Banks

Pay EMI

QPay offers a flexible payment option to benefit both the merchant and the consumer. Under this flexible payment option plan, consumers can choose to pay the total cost of the purchase in easy Equated Monthly Installments (EMI).

This option provides the merchant with more conversion and also helps the consumer to make the purchase and pay according to his cash flow. For more details on EMI Payment options, please contact support@QPayindia.com

Fraud Management

Prevention is always better than damages / losses!

Online fraud and the subsequent damages to merchants / customers are really a matter of concern for QPay. In order to prevent fraud and have a clean / safe transaction process, QPay's risk experts have created an in-built and powerful fraud management system.

The system will analyze and verify each transaction data against various parameters to make sure the transaction is genuine. This improves the transaction success rate and reduces potential chargeback losses.

- Negative & Positive list Verification

- BINs Verification

- CVV Check

- Velocity Checks

- IP & Geography Checks

Mobile Checkout

The QPay Mobile Checkout page feature is available by default in our API and can be used by merchants for their mobile apps / mobile site. In order to cover most of the mobile users, the QPay Mobile Checkout page has been designed to be compatible with iOS, Android, Windows Phone and BlackBerry.

Reports

We provide you with real-time statistical reports, thus enabling you to maximize your business potential with better decisions. Leverage on our reports for understanding your customer & boost your business!

- Today's Transaction

- Transaction by Date

- Transaction by QPay ID

- Transaction by Merchant Order ID

- Success Ratio Report

- Payment Gateway Updates

- Summarized Report

Every customer is important to us!

Easy Integration

We deploy a robust, seamless, fast integration procedure which ensures a secure online cardholder payment to the Merchant. QPay can be easily integrated with your site with minimal cost and effort. Our integration APIs, detailed integration kit and our well defined internal processes enables you to get started in a jiffy.

Our dedicated teams of experts are available 24x7x365 to solve your queries via email, chat and telephone - whenever you need it. We have customised solutions for each customer.

Retry Option

There are occasions when a transaction fails to conclude for reasons due to wrong entry of card details, payment option etc, as a result the customer has to repeat the entire process again. This can be off putting and even results in the customer aborting the transaction and no sale made.

QPay gives customers a choice to use retry option which facilitates just entering the details in the payment page without going through the entire shopping process again. Merchants will benefit from this option because the customer has less chance of not completing the sale!

Multi Currency Support

QPay offers merchants the choice of multi currency payment acceptance. This feature will enable the merchant to conclude the transaction in the currency of the customer’s choice. To enable this feature, Merchants need to inform QPay of the currency they would like to offer and QPay team will handle the rest.

International Card acceptance

QPay also supports acceptance of International cards for goods/services thus allowing the merchant to accept cards without segregation.

Multi- Lingual Checkout Page

QPay gives the convenience of multi-lingual checkout to its merchants. In addition to English, QPay currently supports checkout in Hindi, Tamil and Gujarati for those customers who may prefer a local language content during payments and enhance their shopping experience.

QPay Check out

QPay Checkout provides the customers with an option to store their card details in a secured PCI environment with the flexibility to retrieve and use the same without entering the details again. During the next transaction, all they have to enter is only the CVV and 3D secure password to complete the transaction.

The card details are encrypted and stored allowing repeat customers to have a smooth and easy payment experience. This also facilitates customers to do transactions faster and encourages repeat purchases.

Iframe Integration

This feature allows the customers to have a seamless experience by facilitating the collection of card details in the merchant checkout page. The customer has a uniform experience of being in the merchant page while making a secure payment.

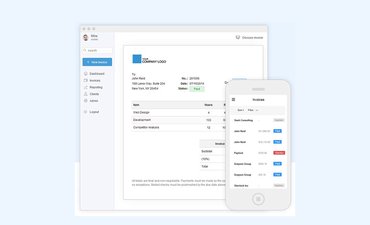

Invoice Payments

QPay offers its merchants the option of generating and sending the invoices at a time of their convenience to its customers with an online payment option. Merchants can create itemized invoices with their logo, look and feel, together with GST and have an online payment option to allow for easy payment of invoices by their customers.

Payment Link via SNIP and QR code

QPay provides its merchants an option to sell and collect payments using the Social Media. Merchants can reach out to their customers in Social media and use QPay payment link to collect payments. Merchants can also generate QR code, display it in Store or publish in print media and collect payments instantly.

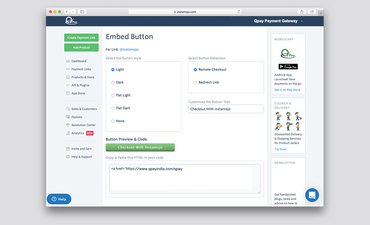

Embed Button

This is a simple and easy way for merchants to collect payments on their static website or blog. The merchants can create a payment facility as an embed button and paste in their site or blog to collect payments easily. No need for payment gateway integration as the embed button provides the facility for online payment collection. Merchants can setup payment buttons easily and start accepting online payments immediately.